- Startup India Registration helps new businesses get government recognition and support.

- It offers tax benefits, funding access, and easy compliance.

- Startups under 10 years old with turnover below ₹100 crore can apply.

- Key perks include 3-year tax holiday and Angel Tax exemption.

- The process is simple via StartupIndia.gov.in with basic documents.

- Experts like Diligence Certifications can guide you for quick approval.

Introduction

In recent years India has been building itself as the startup hub of the world, and the most part of it has come from innovation, the ambition of youth, and support from the government. Indeed, among the most relevant government initiatives in fulfilling this entrepreneurial boom is the Startup India Scheme. Around this flagship initiative launched in 2016, India has been seeking goals of sustainably growing its economy, creating jobs, and turning itself into a friendly nation with startups.

Startup India Registration benefits the eligible business with some tax exemptions, easier compliance, funding opportunities, among other things. Here’s what you need to know regarding Startup India Registration in India, from types of benefits to eligibility, documents required, registration process, fees, and more. This comprehensive blog will be explained by Diligence Certifications, your reliable partner in compliance and registration services.

What is the Startup India Scheme?

The Startup India Scheme is an initiative conceived by the Department for Promotion of Industry and Internal Trade (DPIIT), which comes under the Ministry of Commerce and Industry, in 2016. The objective of the scheme is to:

- Foster innovation and entrepreneurship

- Ease regulatory regime

- Encourage funding

- Give tax exemption

- Set relaxed public procurement norm.

The government seeks to stimulate a startup ecosystem for sustainable development and job creation in several sectors of India.

This will bring together academia, corporations, investors and Government bodies for the prosperity of startups through knowledge sharing and resources, and capital provision.

What is Startup India Registration?

Registration under Startup India is the formal recognition process by the DPIIT wherein a business entity is considered a Startup. A registered startup stands to avail many benefits under the Startup India Scheme, such as tax holidays, easier compliance, fast-track exit options, IPR support, and funding assistance.

A Startup India Registration Certificate is issued by the DPIIT to prove eligibility of a startup under the scheme.

This recognition not only increases the entity’s credibility in the eyes of all stakeholders but also draws in the possibility of national and international collaborations.

Why is Startup India Registration Important?

For the following reasons, registration is imperative for new ventures under the Startup India Scheme:

- Government Recognition: Validation and an opportunity to entitle a company to various schemes and incentives.

- Tax Benefits: A 3-year tax exemption is offered together with capital gains tax exemptions.

- Funding Opportunities: Various government funds such as ₹10,000 crore Fund of Funds for Startups (FFS).

- Ease Of Doing Business: Faster trademark and patent registrations, easy compliance, and relaxation in public procurement.

- Networking Support: Participation in Startup India events, summits, and workshops.

On top of that, a recognized startup has the potential to connect to investors and accelerators via the Startup India portal further enhancing its growth potential.

Eligibility Criteria For Startup India Registration in India

The following eligibility criteria must be satisfied for Startup India Registration of startups in India:

1. Type of Entity:

- Private Limited Company (under Companies Act, 2013),

- Limited Liability Partnership (LLP),

- Registered Partnership Firm.

2. Age of the Business:

- It should not be more than 10 years old from the date of incorporation.

3. Turnover:

- It should not have an annual turnover exceeding ₹100 crore in any of the previous financial years.

4. Innovation:

- The business must be engaged in innovation, improvement of products/services, or scalable business models.

5. Original Entity:

- The entity should not have been formed by splitting up or reconstructing an existing business.

The eligibility requirements are important in themselves to qualify in DPIIT recognition under Startup India Scheme.

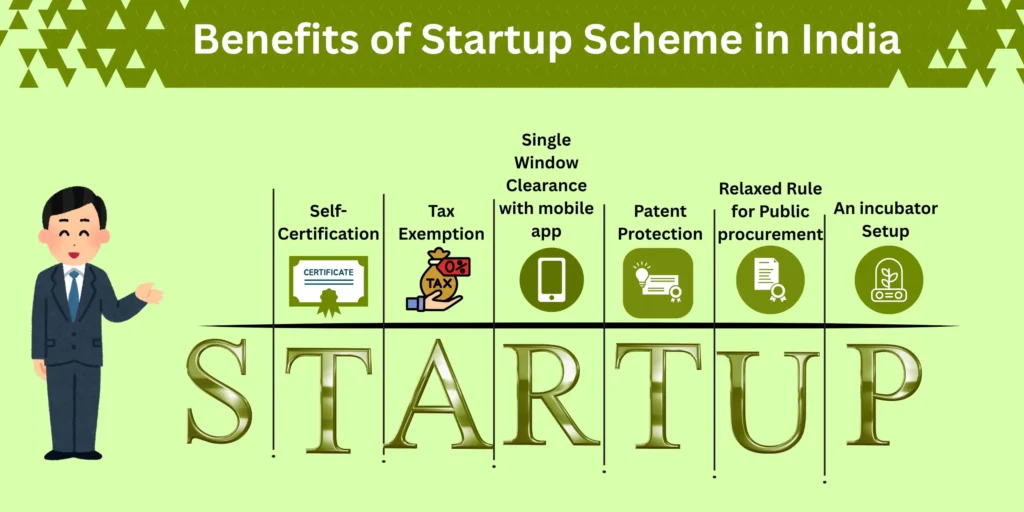

Benefits of Startup India Registration

The benefits enjoyed by DPIIT-recognized startups are the following:

1. Income Tax Exemption

- Eligible startups can claim 100% exemption from tax on profits for three consecutive years as per the provisions of Section 80-IAC of the Income Tax Act.

2. Angel Tax Exemption

- If meeting the prescribed conditions, all startups will be allowed an exemption from Angel Tax under Section 56(2)(viib).

3. Self-Certification for Compliance

- Startups can self-declare compliance with 6 labor laws and 3 environmental laws for a period of 5 years.

4. Faster Patent Examination

- Those startups get an 80% rebate in patent filing fees and fast track examination for IPRs.

5. Easy to Wind up

- Winding up could be completed within 90 days and is made easy under the Insolvency and Bankruptcy Code.

6. Access to the Startup India Hub

- Access to a one-stop platform for funding, mentorship, incubators, and networking opportunities at the Startup India Hub.

7. Public Procurement Benefits

- Startups could participate in public tenders from the Government without any prior experience or turnover and thus could leverage their opportunity in projects under the public sector.

8. Connecting and Learning

- Startups can participate in various learning activities, boot camps, and investor meets organized by DPIIT.

Documents Required for Startup India Registration

Below is a list of required documents for Startup India Registration in India:

- Certificate of Incorporation/Registration from MCA/Registrar of Firms

- Entity PAN Card

- Details of directors/partners

- Business pitch deck or brief about product/service

- Proof of innovation, including patent, MVP, R&D data, etc.

- Authority letter if applying through a representative

- Proper documentation means faster approval and DPIIT recognition smoother.

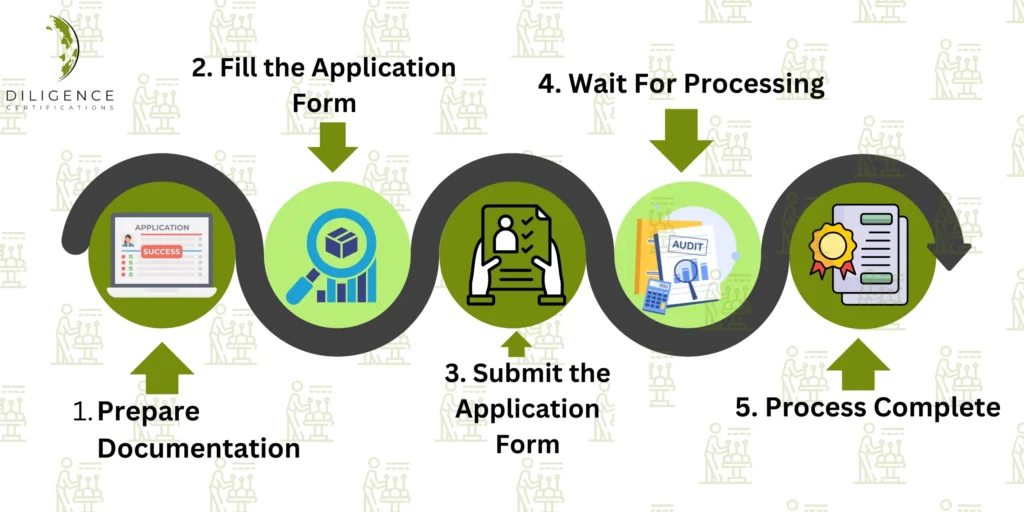

How to Apply For Startup India Registration

Startup India Registration Certificate may be obtained through the DPIIT in a few steps.

Step 1: Incorporate the Business

- Private Limited Company, LLP, or Partnership Firm: Incorporate your business under the respective laws.

Step 2: Register on Startup India Portal

- Visit startupindia.gov.in, create an account and register as a user.

Step 3: Apply for DPIIT Recognition

Under “DPIIT Recognition”, fill in the application form with requisite details such as:

- Nature of business

- Industry sector

- Details of innovation

- Funding stage

- Team profile.

Upload the relevant documents.

Step 4: Submit Declaration

- Accept the declaration and submit the self-certification regarding eligibility.

Step 5: Get Startup India Registration Certificate

- Afterward, the Startup India Registration Certificate will be given to your business upon the successful verification and approval by DPIIT.

Startup India Registration Fees

The affordability factor is one of the key things you would love about the Startup India Scheme. The Startup India Registration Fees is completely waived.

- No government fee is charged for registration under DPIIT.

- Standard MCA fees do, however, apply when incorporating your new business entity (like a Pvt Ltd Company or LLP).

Diligence Certifications provides reasonable Startup India registration packages containing legal documentation, business plan preparation, filing of application with DPIIT, and post-registration support.

Timeline For Registration

Startup India Registration in India takes an average of around 7 to 10 working days, provided all documents and application details are in order.

If the document submission is delayed or wrong information has been provided, then the certification could be rejected or delayed; therefore it is better to go with experts like Diligence Certifications to speed up the process.

Common Mistakes to Avoid in Startup India Registration

Inadequate business description: Indicating how the product or service is innovative or scalable.

- Missing Documents: Upload all required proofs of innovation and registration.

- Wrong type of entity: India eligible only LLPs, Pvt. Companies or Registered partnerships.

- Inconsistent Information: Ensure the DPIIT application is congruent with the MCA records.

- Using Unofficial Channels: Always use the official Startup India portal to submit your applications.

With its Diligence Certifications, such errors may be avoided, and a seamless registration experience is probable.

Why Choose Diligence Certifications For Startup India Registration?

Here at Diligence Certifications, we offer specialized expertise to support and guide the entire regulatory and compliance processes. This is why Startups all over India trust our services:

Experienced Consultants: Well aware of DPIIT norms and Startup India eligibility.

Complete Documentation Assistance: From preparing pitch decks to drafting declarations.

Affordable Packages: Transparent pricing, no hidden costs.

On-time Registrations: Quick filing with result updates all to avoid delays.

Pan India Support: We assist startups in every Indian state and city.

Diligence Certifications assists Startups in getting their Startup India Registration as fast, easy, and hassle-free as possible, whether it’s the first start-up launch or an existing business expansion.

Conclusion

Startup India Registration is a fundamental process that every entrepreneur should undertake if they want to create their scalable and innovative venture in India. The program has well over a dozen benefits like tax holidays, funding sources, and regulatory flakiness, all of which are going to redefine the framework for startups in India.

So, if you want a smooth path to leaving your imprint on the world, you can rely on Diligence Certifications for a hassle-free registration. Diligence has specialists, all ready to ensure the accuracy, completeness of application, and compliance so you can spend more time growing your business.

The future is here. Get your Startup India Registration Certificate from Diligence Certifications and fulfill your entrepreneurial dream.

Frequently Asked Questions

What is Startup India Registration in India?

An Approval from DPIIT that treats an Indian Startup as innovation-driven and grants eligibility to Tax Holidays, Angel Tax exemption, IPR benefits and concession for procurements.

Who can apply?

Private Limited company, limited liability partnership (LLP) and registered partnership firms within 10 years of incorporation with a prescribed Turnover Limit are eligible.

What documents do I need?

Certificate of Incorporation, PAN, MOA/AOA or partnership deed, particulars of Director/Partner and Innovation Statement of 500 words.

How long does it take to get an approval ?

1-3 weeks for a clean application, again clarifications could take this to 4-8 weeks.

What is the turnover limit?

Historically the limit was ₹100 crore any financial year, please confirm the Limit before filing with DPIIT.

Does it automatically give me tax benefits?

No, you still have to file a separate application for tax benefits under section 80-IAC and for the Angel Tax Exemption from the Income Tax department.

Can foreign founders apply?

Yes, as long as the company is registered in India and the company complies with foreign direct investment norms.

What happens if I go beyond the turnover limit ?

The startup may lose the Tax or the funding eligibility, and future benefits will cease.

Is there any relaxation of compliance?

Yes, startups enjoy self-certification in some labour and environment laws. Startups are also exempt from EMD and prior experience in Government tenders.

Does Startup India help with patents or trademarks?

Yes, under SIPP scheme, a startup will get an 80% rebate on patent filing fees, 50% cost to obtain trademarks and get assistance in fast-tracking examination.

BIS Certification

BIS Certification

CDSCO

CDSCO

CPCB

CPCB

LMPC

LMPC

WPC Approval

WPC Approval

Global Approvals

Global Approvals

TEC

TEC

ARAI

ARAI

BEE

BEE

ISO Certification

ISO Certification

Drone Registration

Drone Registration

NOC For Steel

NOC For Steel

Business Registration

Business Registration

Legal Services

Legal Services

Trademark Registration

Trademark Registration

Copyright Registration

Copyright Registration

Patent Registration

Patent Registration