- An OPC only needs one shareholder and one nominee.

- The Companies Act, 2013 does not require a minimum paid-up capital.

- The DSC (Digital Signature Certificate) and DIN (Director Identification Number) are required.

- File SPICe+ Form (Part A & B) for name reservation and incorporation.

- The entire process is completed online and takes approximately 7 – 10 working days.

Introduction

One Person Company Registration in India has become a popular choice for solo entrepreneurs who want the legal benefits of a private limited company without needing partners. With a streamlined registration process under the Companies Act, 2013, One Person Company offers limited liability, a separate legal identity, and full control to a single founder.

This 2025 guide is brought to you by Diligence Certification, walking you through the whole range of OPC registration, including eligibility, documents required, cost breakdowns, and how to register a One Person Company online seamlessly and hassle-free.

What Is a One Person Company?

A One Person Company (OPC) is a new type of company formed through the Companies Act, 2013. It allows one person to run a company and enjoy the benefits of a corporate structure, by blending characteristics of sole proprietorships and limited liability companies.

OPC is helpful for one-person businesses, individual consultants, digital creators and freelancers who want to achieve some formality and legal structure but want to maintain complete control. A sole proprietorship puts personal assets at stake if there are business losses. An One Person Company keeps the founder and the company apart, and the owner is liable only to the amount of the owner’s financial commitment in the company.

With the added benefits of credibility, greater access to funding and compliance structured, OPC is a wise choice for individuals who want to formalize their venture and build professionally while working independently.

Why Register an OPC Company?

Now, before we get into the OPC registration process, let’s look at some of the reasons why more and more entrepreneurs are excited about getting an OPC company registered:

- Limited liability protection

- Corporate recognition and brand credibility

- Easy funding and loan accessibility

- Continuity or Perpetual Succession

- Complete control over the business by a single person

- More simplified compliance compared with private limited companies

All these features should definitely increase your desire to get an OPC started in case they agree with your business motives.

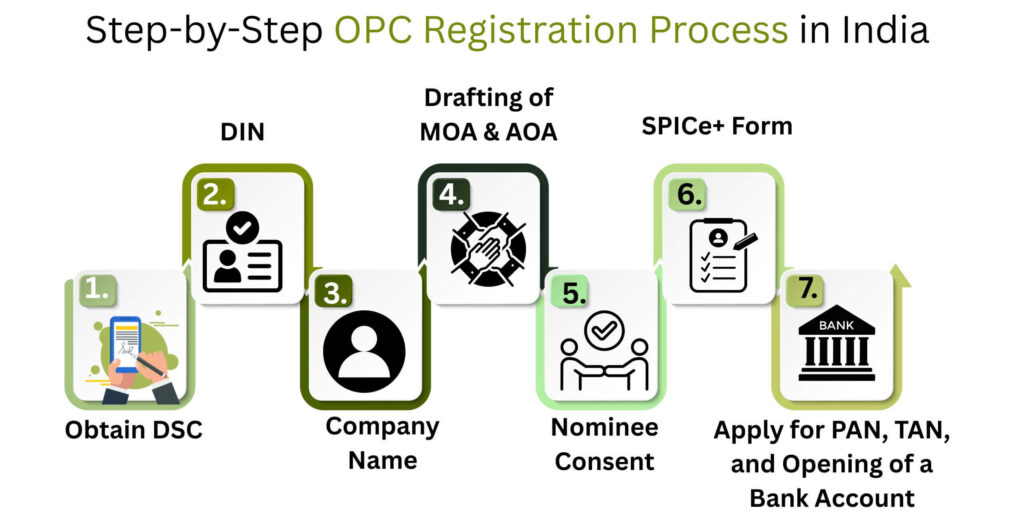

Step-by-Step OPC Registration Process in India [2025]

Here is a detailed breakdown of how to register a One Person Company in India through a recognized consultancy like Diligence Certification:

Step 1: Acquire Digital Signature Certificate(DSC)

The first step towards completing OPC registration online is obtaining the Digital Signature Certificate(DSC) in the name of the Director/Promoter. Since filing with the Ministry of Corporate Affairs(MCA) is done in electronic form, a DSC becomes mandatory.

Documents Required for the DSC:

- PAN card of the applicant.

- Aadhaar card.

- Passport-sized photograph.

- Email ID and mobile number.

Note: Diligence Certification assists the applicant in getting the DSC in 1-2 working days.

Stage 2: Ultimately for Election to Director Identification Number (DIN)

The Director Identification Number comes into play after obtaining the DSC. The DIN is a unique identification number given to every director of a company. Generally, it is applied together with the SPICe+ form for merging a one-person company.

Step 3: Company Name Must Be Unique

Choosing a unique and suitable name becomes the most important aspect of OPC registration. The name must be compliant with the MCA naming regulations and must not be similar to existing companies or trademarks.

You can apply for a name reservation as per Part A of the SPICe+ form. Diligence Certification helps in checking the availability of names and ensuring proper, smooth handling of name approval.

Step 4: Drafting of MOA & AOA

The next step is preparing the Memorandum of Association (MOA) and the Articles of Association (AOA):

MOA: Detailing the aims and ambit of your OPC.

AOA: Setting out the internal rules and administrative framework.

These will be submitted for registration of the OPC company with the MCA through the SPICe+ form.

Step 5: Nominee Consent

According to Section 3 of the Companies Act, 2013, one must nominate the person who will take over the OPC in case the owner has succumbed to death or is disabled. The consent of the nominee is filed via Form INC-3. Diligence Certification assures that all the nominee’s legal formalities have been duly taken care of.

Step 6: The SPICe+ Form for Incorporating the Company

The SPICe+ (Simplified Proforma for Incorporating a Company Electronically Plus) form is central to the incorporation process of OPC.

- Name reservation

- Allotment of DIN

- Application for PAN & TAN

- Issuance of Incorporation Certificate

All the documents are uploaded onto the MCC portal, and once approved, registration for your OPC, then, is complete online.

Step 7: Applicable for PAN, TAN, and Opening of a Bank Account

Once the certificate of incorporation is issued, the company PAN and TAN get automatically generated. These formalities would allow you to open a current bank account.

Diligence Certification offers a package to assist a business bank account that is compliant with the law after its registration.

Documents Required for OPC Registration

The following documents are required to register a One Person Company (OPC) under the provisions of the Companies Act, 2013:

For the Sole Director and Shareholder (same person): –

1. Mandatory PAN Card – is a Government issued identity proof.

2. Aadhaar Card – for identity and address proof.

3. Current Passport (if NRI/Foreigner) must be notarised and apostilled (if needed).

4. Any one of these as additional identity proof – Voter ID / Driving License / Passport

5. Current Utility Bill / Bank Statement (not more than 2 months old) – as proof of residential address.

For Registered Office Address:

6. Electricity Bill / Water Bill / Receipt for Property Tax – as proof of ownership or use of the property.

7. NOC (No Objection Certificate) – from property owner, giving right to use the property as Registered Office.

8. Rent Agreement or Sale Deed – is needed if rented or owned.

Other Papers required:

9. Digital Signature Certificate (DSC) – to sign forms digitally.

10. Director Identification Number (DIN) – can also be applied along with incorporation (Form SPICe+).

11. Memorandum of Association (MoA) – describing the purpose to which it was set up.

12. Articles of Association (AoA) – Internal rules and set up.

13. Nominee’s Consent (form INC-3) – appoint a nominee who can take over in the event the south member is incapacitated due to death or otherwise.

14. Nominee’s identity & address proof – same requirements as the director.

Benefits of OPC Registration

- Limited liability for the owner

- Full control and ownership

- Separate legal identity

- Easy funding opportunities later

- Fewer compliance requirements than Pvt Ltd

Timeline for OPC Registration

With expert assistance from Diligence Certification, the entire process to register a One Person Company can be completed in 7 to 10 working days, depending on document readiness and government approvals.

Post-Incorporation Compliance for OPC

After OPC registration, the business must comply with certain regulatory obligations:

- Appointment of Auditor within 30 days

- Annual ROC filings (Form AOC-4 and MGT-7A)

- Maintenance of proper account books of accounts

- Income tax returns filing

- GST registration, if applicable

Diligence Certification provides ongoing compliance support to ensure your OPC remains legally sound.

Why Choose Diligence Certification for Online OPC Registration?

At Diligence Certification, we simplify the online OPC registration process with a personalized, expert-led approach. Here’s why startups and solo founders choose us:

- Expert consultation on company structure

- Fast-track DSC and DIN application

- Name availability search and approval

- Transparent OPC company registration fees

- End-to-end document drafting and filing

- Dedicated relationship manager for updates

- Post-incorporation compliance support

Conclusion

Registering a One Person Company in India gives solo entrepreneurs the chance to build a strong business identity with limited liability and full control. With simplified rules and online processes in 2025, forming an OPC is faster and easier than ever before.

If you’re looking to get started quickly and without errors, consider partnering with a professional like Diligence Certification to handle the entire process — from DSC to COI — and focus on growing your dream business.

Frequently Asked Questions (FAQs)

Can a salaried person register an OPC?

Yes, a salaried person shall register an OPC if he/she is not forbidden from engaging in other business activities as per the employment contract. It is best to verify with your employer before continuing.

What is the minimum capital for OPC registration?

Since there is no minimum paid-up capital requirement according to current norms, one can register an OPC duly with capital of ₹1.

Can an OPC be converted into a private limited company?

Yes, an OPC can be voluntarily converted into a private limited company after 2 years or compulsorily on crossing ₹2 crores paid-up capital or ₹20 crores turnover.

Is GST registration mandatory for an OPC?

GST registration would only be mandated if the turnover exceeds ₹40 lakhs (₹20 lakhs in special category states) or if they are inter-state supply of goods/services.

Is it required to have a commercial office address for OPC registration?

Not mandatory; a residential address can also be used as the registered office of an OPC. However, proper address proof and NOC from the property owner need to be submitted.

Can an OPC have more than one director?

No, only one shareholder is allowed, but additional directors can be appointed.

Can I run more than one OPC?

No, one person can only form one OPC at a time.

Is nominee appointment mandatory for OPC?

Yes, a nominee is mandatory and must consent via Form INC-3.

Can an NRI register an OPC in India?

No, only Indian residents can incorporate an OPC.

Is audit required for an OPC?

Yes, annual audit is compulsory for all OPCs.

BIS Certification

BIS Certification

CDSCO

CDSCO

CPCB

CPCB

LMPC

LMPC

WPC Approval

WPC Approval

Global Approvals

Global Approvals

TEC

TEC

ARAI

ARAI

BEE

BEE

ISO Certification

ISO Certification

Drone Registration

Drone Registration

NOC For Steel

NOC For Steel

Business Registration

Business Registration

Legal Services

Legal Services

Trademark Registration

Trademark Registration

Copyright Registration

Copyright Registration

Patent Registration

Patent Registration