Latest updates and announcements from the certification and regulatory compliance world.

Interactive webinars and sessions on certification, standards and regulatory requirements.

Detailed insights and best practices on India’s product certification processes.

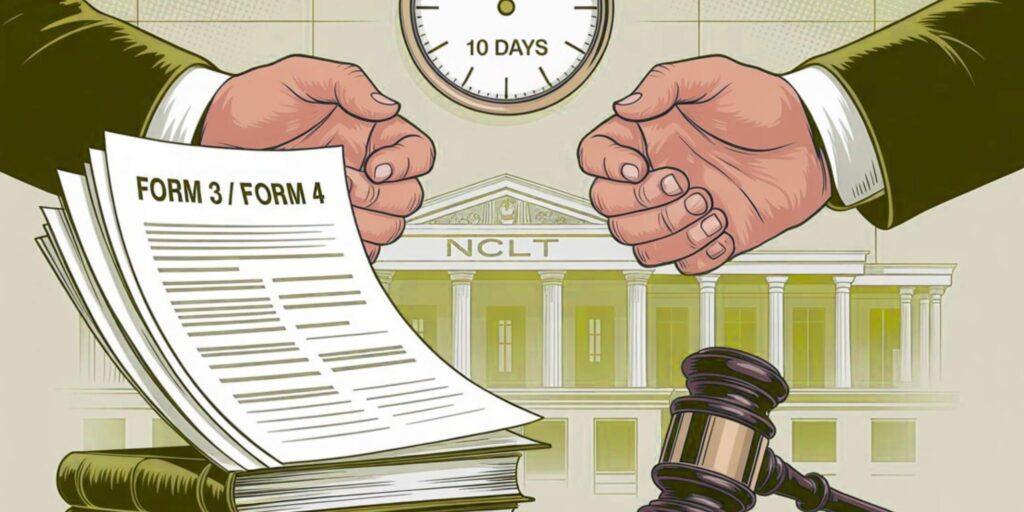

Visual breakdowns of certification steps to make compliance easier to understand.

BIS Certification

BIS Certification

CDSCO

CDSCO

CPCB

CPCB

LMPC

LMPC

WPC Approval

WPC Approval

Global Approvals

Global Approvals

TEC

TEC

ARAI

ARAI

BEE

BEE

ISO Certification

ISO Certification

Drone Registration

Drone Registration

NOC For Steel

NOC For Steel

Business Registration

Business Registration

Legal Services

Legal Services

Trademark Registration

Trademark Registration

Copyright Registration

Copyright Registration

Patent Registration

Patent Registration